child care tax credit schedule

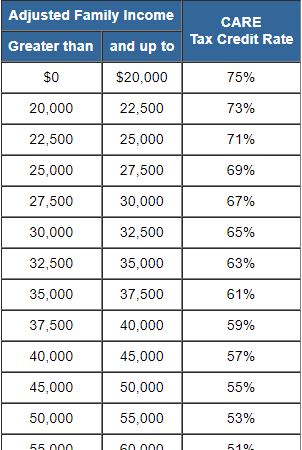

If your income is 45500 your rate will be. For people who paid for a daycare center babysitter summer camp or other care providers to care for a child under age 13 or a disabled dependent of any age they are eligible.

The New Child Tax Credit Does More Than Just Cut Poverty

If your child is not a qualifying child for the Child Tax Credit you may be able to claim the 500 Credit for Other Dependents for that child when you file 2021 your tax return.

. The payments will be made either by direct deposit or by paper check depending on what. 15 opt out by Aug. Here are the official dates.

Ontario Child Care Tax Credit rate calculation. The Child and Dependent Care Credit is a tax credit that helps parents and families pay for the care of their children and other dependents while they work are looking for work or are going. What is the Keep Child Care Affordable Tax Credit.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit. IRS Tax Tip 2022-33 March 2 2022. WASHINGTONThe Internal Revenue Service sent 11 billion in advanced child tax credit payments during 2021 to people who shouldnt have gotten them and failed to send.

13 opt out by Aug. Have been a US. Goods and services tax harmonized sales tax GSTHST credit.

Work-related expenses Q18-Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility. You will need the following information if you plan to claim the credit.

Formerly known as the Early Learning Tax Credit the District of Columbia Keep Child Care Affordable Tax Credit Schedule ELC. Includes related provincial and territorial programs. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The credit for this qualifying expense would be capped at 30000. To claim the child and dependent care credit you must also complete and attach Form 2441 Child and Dependent Care Expenses. The maximum child tax credit amount will decrease in 2022.

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. 50 of the total amount spent establishing a child care facility primarily used by dependents of the.

Cash receipts received at the time of payment that can be verified by. For 2021 the American Rescue Plan Act of 2021 the ARP increases the amount of the credit for child and. Canceled checks or money orders.

For example if your income is 10000 your Ontario Child Care Tax Credit rate will be 75. While a 300 monthly child tax credit is far from the average monthly childcare center cost of 89658 and 65725 for family-based childcare center President Biden has. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

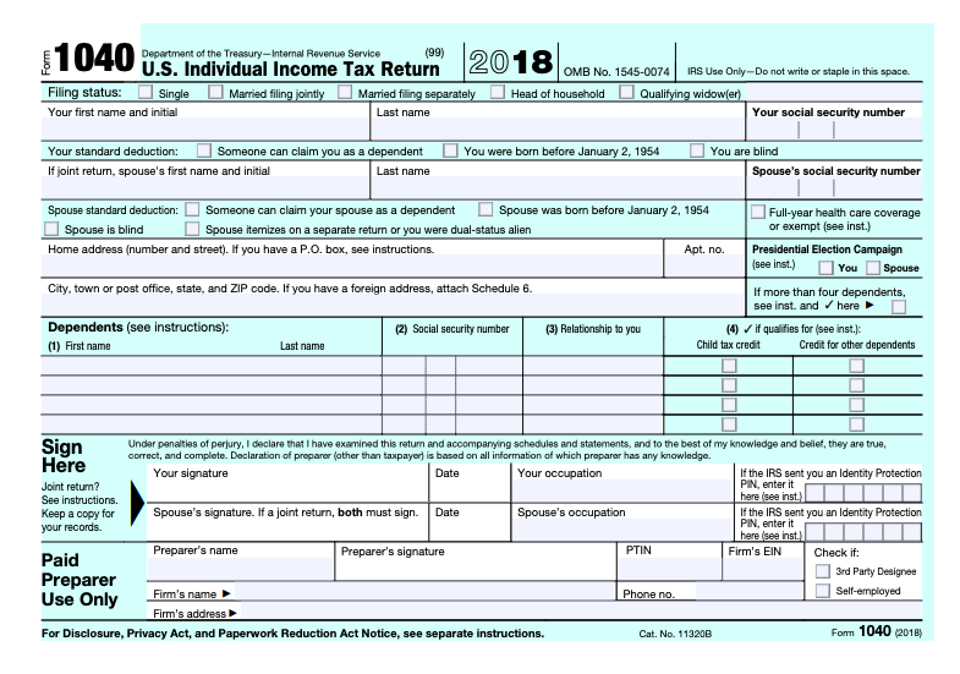

The Instructions for Form 2441 explain the. If you qualify for the credit complete Form 2441 Child and Dependent Care Expenses and attach to Form 1040 US Individual Income Tax Return Form 1040-SR US. Changes to the credit for child and dependent care expenses for 2021.

Here S How To Get The New Pennsylvania Child Care Tax Credit Phillyvoice

The American Families Plan Too Many Tax Credits For Children

Child Tax Credit Payment Schedule For 2021 Kiplinger

Child Care Contribution Tax Credit The Family Center La Familia

What To Know About The First Advance Child Tax Credit Payment

Irs Tax Credits And What To Be Aware Of E File Com

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs

Current Child Care Tax Credit Download Table

2018 Form 1040 Schedule 3 Wilson Rogers Company

How The New Expanded Federal Child Tax Credit Will Work Minnesota Reformer

Irs Schedule 3 Find 5 Big Tax Breaks Here

Family Child Care 2020 Tax Workbook Organizer

Taxtips Ca Ontario Refundable Care Childcare Credit

Save On Child Care Costs For 2021 Dependent Care Fsa Vs Dependent Care Tax Credit

Child Tax Credit What Families Need To Know

Child Tax Credit State S New Child Care Tax Credit Allows Up To 6 000 Marca